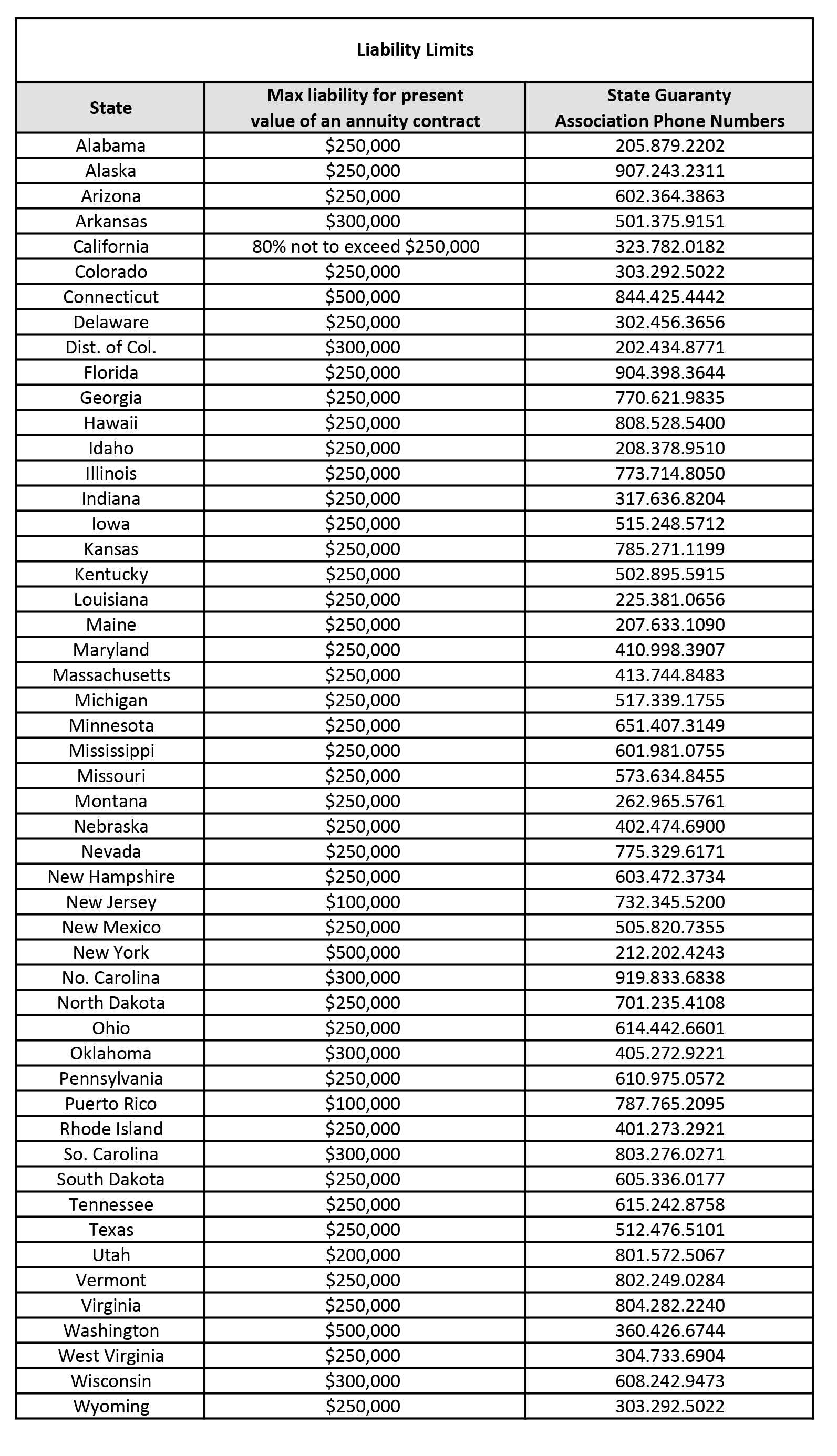

In general, states have funds to help pay claims of insurance companies that become financially impaired. Laws vary from state to state as does the insurance coverage and dollar limits that are payable. For the most part, coverage is for individual policyholders and their beneficiaries and not for values held in unallocated group contracts.

As each state has different rules and regulations with regard to the type and the extent of coverage available, you are advised to consult your state insurance department for details about any policy you are considering purchasing or becoming a party of.

*Source:annuityadvantage.com

Disclaimer: Provided for informational purposes only and not for the purpose of sales, or solicitation. Mainstay Capital Management is not responsible for the accuracy of this information. If you wish to confirm these coverages, please call your state insurance department.